The Three Major Financial Statements: How They’re Interconnected

by baraknew

Contents:

Accounting software often automatically calculates interest charges for the reporting period. If you prepare the income statement for your entire organization, this should include revenue from all lines of business. If you prepare the income statement for a particular business line or segment, you should limit revenue to products or services that fall under that umbrella. Once you know the reporting period, calculate the total revenue your business generated during it. By doing this, the income statement for June reports only June transactions, and the income statement for July reports only July transactions.

Comprehension develops as studies progress, and a future chapter is devoted to the statement of cash flows. Assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. Most companies expect to sell their inventory for cash within one year.

AR-C 70: The Definitive Guide to Preparations

Next, $560.4 million in selling and operating expenses and $293.7 million in general administrative expenses were subtracted. This left the company with an operating income of $765.2 million. To this, additional gains were added and losses subtracted, including $257.6 million in income tax.

WalkMe : Notice and Proxy Statement for the 2023 Annual General Meeting – Form 6-K – Marketscreener.com

WalkMe : Notice and Proxy Statement for the 2023 Annual General Meeting – Form 6-K.

Posted: Mon, 10 Apr 2023 20:06:06 GMT [source]

A what is bookkeeping‘s income statement provides details on the revenue a company earns and the expenses involved in its operating activities. It’s the creation of the balance sheet through accounting principles that leads to the rise of the cash flow statement. Often, the first place an investor or analyst will look is the income statement. The income statement shows the performance of the business throughout each period, displayingsales revenueat the very top. The statement then deducts the cost of goods sold to findgross profit. The second statement, the statement of owner’s equity, summarizes the increases and decreases in the owner’s equity.

Breaking Down the Order of Financial Statements

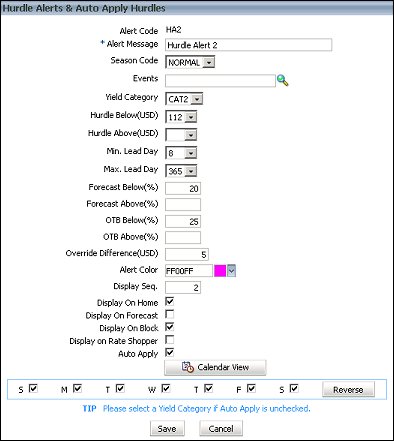

Once the client makes the request, the accountant will create an engagement letter in compliance with AR-C 70. The preparation guidance does not apply when the accountant is merely assisting in the preparation of financial statements; such services are considered bookkeeping. Take a couple of minutes and fill in the income statement and balance sheet columns. The next step is to determine gross profit for the reporting period.

https://1investing.in/ statements have been created on paper for hundreds of years. The growth of the Web has seen more and more financial statements created in an electronic form which is exchangeable over the Web. Common forms of electronic financial statements are PDF and HTML.

Inclusion in annual reports

When creating a trial balance for 2 months, e.g Jan & Feb, will the closing balances of the accounts for Jan, carry over to Feb or is each trial balance specific to the transactions that occurred in a month. The statement of cash flows requires a fairly complete knowledge of basic accounting. Do not be concerned by a lack of complete comprehension at this juncture.

Routine, daily operating events – represents over 99% of all transactions. Double-entry accounting follows one simple rule, called the accounting equation. Are prepared for a fee by the Financial Accounting Standards Board.

Expenses can be listed alphabetically or by total dollar amount. In double-entry bookkeeping, the income statement and balance sheet are closely related. Double-entry bookkeeping involves making two separate entries for every business transaction recorded. One of these entries appears on the income statement and the other appears on the balance sheet. FreshBooks provides a range of income statement and balance sheet examples to suit a variety of businesses, no matter if you have just started out or if you are looking for a different solution. Both the profit and loss account and the balance sheet are likely to be mentioned in the business press and other financial media whenever a significant enterprise presents its accounts.

- Once you know the reporting period, calculate the total revenue your business generated during it.

- The balance sheet lists the assets, liabilities, and equity of a business organization at a specific moment in time and proves the accounting equation.

- Are you aware of the option in the SSARS titled Preparation of Financial Statements (AR-C 70)?

- The specific items that appear in financial statements are explained later.

This is necessary so financial statement users get a true and complete financial picture of the company. Provide information about the profitability and financial position of the company. Financial information comes in many forms, but the most important are the Financial Statements. They summarize relevant financial information in a format that is useful in making important business decisions. If this were not possible, the whole process would be a waste of time. Financial statements summarize a large number of Transactions into a small number of significant categories.

Financing Activities

The balance sheet is broken into three categories and provides summations of the company’s assets, liabilities, and shareholders’ equity on a specific date. The statement of cash flows shows the firm’s financial position on a cash basis rather than an accrual basis. The cash basis provides a record of revenue actually received, from the firm’s customers in most cases. The accrual basis shows and records the revenue when it was earned. If a firm has extended billing terms, such as 30 days net, 60 days 1 percent, these two methods can produce substantially different results. Once business resumes on November 1st, all the numbers on the balance sheet will change as well, and we’ll start a new income statement and a new statement of owner’s equity to report November transactions.

After you generate your final financial statement, use your statements to track your business’s financial health and make smart financial decisions. To have a more thorough look at how double-entry bookkeeping works, head to FreshBooks for a gallery of income statement templates. 84% of retail investor accounts lose money when trading CFDs with this provider. I am a long-time follower of your work, so I know your opinion is well worth consideration. The purpose of my post is not to promote its use but to educate those who might desire to use it. No doubt the preparation service can open the door to additional litigation risk.

For example annual statements use revenues and expenses over a 12-month period, while quarterly statements focus on revenues and expenses incurred during a 3-month period. The income and expense accounts can also be subdivided to calculate gross profit and the income or loss from operations. These two calculations are best shown on a multi-step income statement. Gross profit is calculated by subtracting cost of goods sold from net sales.

On the left side of the balance sheet, companies list their assets. On the right side, they list their liabilities and shareholders’ equity. Sometimes balance sheets show assets at the top, followed by liabilities, with shareholders’ equity at the bottom. Generally, a comprehensive analysis of the balance sheet can offer several quick views. In order for the balance sheet to ‘balance,’ assets must equal liabilities plus equity. Analysts view the assets minus liabilities as the book value or equity of the firm.

A preparation engagement can be applied to historical financial statements and historical information (e.g., specified items of a financial statement). AR-C 70, Preparation of Financial Statements, is the guidance for the preparation of financial statements. It tracks expenses by entity function, typically separated into administrative, program and fundraising expenses. Disseminated to the public, the statement of functional expenses details what proportion of company-wide expenses are related directly to the company’s mission.

Your assets must equal your liabilities plus your equity or owner’s investment. You have used your liabilities and equity to purchase your assets. Thebalance sheetshows your firm’s financial position with regard to assets and liabilities/equity at a set point in time.

Recommended Posts

Accounting and Consulting Services for Wineries, Vineyards

April 12, 2024

Times Interest Earned Ratio: What It Is, How to Calculate TIE

August 30, 2021

What is the normal balance?

April 2, 2021