Fusion Markets Review 2022 Pros and Cons Dennis Piper

by baraknew

Fusion Markets offers only a demo account as an educational tool. Educational videos, platform tutorial videos https://forex-reviews.org/ and educational texts are not available. You can change leverage levels at Fusion Markets, which is great.

The product portfolio is largely limited to forex and some CFDs. Fusion Markets is regulated by the top-tier Australian authority ASIC as well as the regulator of Vanuatu. It provides negative balance protection for clients under ASIC. If you want to use the demo account, first you have to enter your email address and set a password. Then you have to log in to the client portal, where you can select the demo account on the ‘Accounts’ page. Fusion Markets hasa live chat service that provides quick responses.We received relevant answers to our questions within seconds.

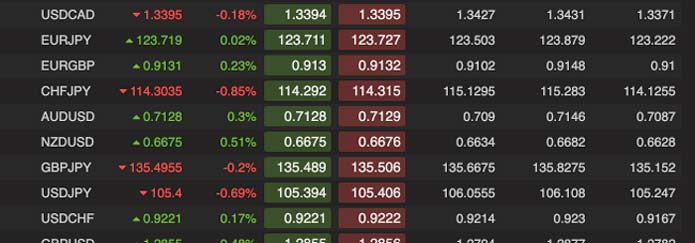

Spreads

Despite this, Fusion Markets is still a great broker for experienced traders due to the exceptional trading conditions that they offer. They have a strong reputation for reliability, transparency, and providing excellent value to their clients, making them a top choice for many experienced traders. I feel that they have a personalised approach and put clients’ interests at the forefront of everything that they do. You can trade on powerful yet intuitive platforms for your desktop and mobile devices. I found the trading conditions to be excellent and there is a decent number of financial instruments to choose from. I like that we get access to additional trading tools and good variety of payment options.

He is a motivated finance expert, having joined BrokerChooser in 2018. He’s also eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. In his spare time, he loves learning new things, especially data science, algo trading, programming and trading. On the negative side, Fusion Markets haslimited educational tools.

Account Types

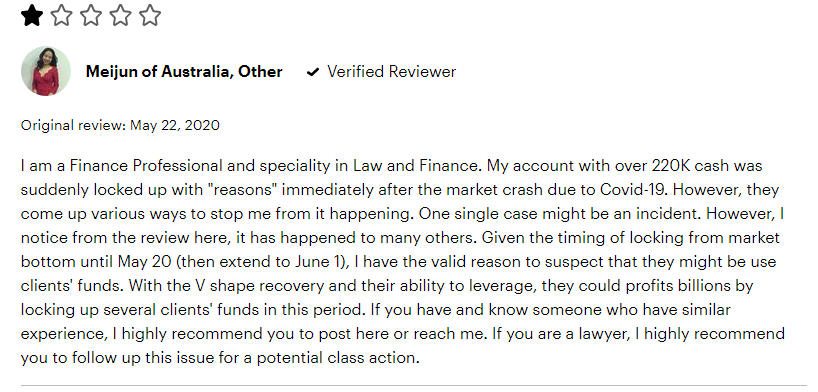

Trading costs on both accounts are much lower than most other brokers. However, the Vanuatu Financial Services Commission is an offshore zone and sets very low requirements with very small costs, and almost does not oversee the company operation further on. So, we do not recommend traders to trust their funds to a broker holding an offshore license.

If trading through a Classic account, spreads start from 0.8 pips on major currency pairs, and trading is commission-free. The fees you incur will depend on which account type you choose to open. There are three main Fusion Markets account types to choose from. A swap-free account type is also available on request for Islamic traders and those who require it.

How to withdraw your money from Fusion Markets?

To Withdraw your profits from Fusion Markets, follow the steps below: – Log in to the client portal- Select ‘Payments’- Click ‘Withdrawal’- Write the amount you wish to withdraw and choose the withdrawal method- Make the withdrawal

Alongside the desktop platforms, MetaTrader WebTrader platform is available and can be accessed within your browser without the need for a download. On mobile, both the MT4 and MT5 mobile platforms are available through apps that can be downloaded on iOS and Android devices. These mobile platforms have all of the functionality of the other platform types and are very easily accessible to traders. Overnight fees are applied according to the rates at that time when traders hold CFD positions open after the close of the market. This fee is not charged on the swap-free account, though there may be other fees in its place.

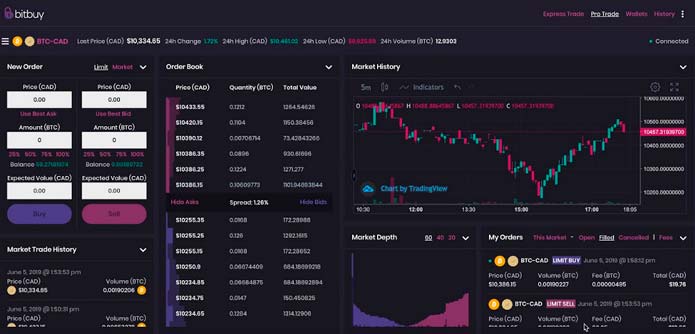

Commissions and Fees

By offering CFDs as opposed to trading the assets themselves, Fusion Markets allows traders to gain exposure to several markets via a single trading environment. By focusing exclusively on CFDs, Fusion Markets is able to offer a streamlined service and make trading much more accessible to those who are perhaps new to the financial markets. Currently, in my judgment, I believe that fusionmarkets is a qualified broker. At first I felt good after using their MT4 demo account, so now I started to experience the MT4 real account. It offers a wide variety of trading instruments, and I can trade the ones I like and hold various positions.

- Fingerprint and Face ID authentication are not available, which is bad news for many traders.

- Fusion Markets has two accounts with very low trading costs compared to other brokers, and neither trading account has a required minimum deposit.

- Fusion Markets meets this criterion by offering two different account types – the Classic Account and the Zero Account.

- Their swap charges may not be the cheapest among other brokers, but this will only affect clients that tend to leave their orders open in the long term.

- You can easily customise the platform according to your own individual needs.

Fusion Markets is an Australia-based discount forex broker, regulated by the ASIC, VFSC and FSA Seychelles. Fusion Markets has low trading and non-trading fees and the account opening is easy and fast. The broker operates a great customer service that provides fast and relevant answers.

What is The Minimum Deposit at Fusion Markets?

Typically, the MT4 platform is better for more advanced users. Users choose which account type they want when initially signing up to the platform. Both accounts allow users to access all the same Fusion Markets features and tools.

You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Fusion markets is a regulated broker that mostly provides trading products. fusion markets review You can choose from MT4 or metatrader5 on both desktop and mobile. Fusion Markets offers more than 250 financial products to trade in across a number of the most popular markets in the industry. Firstly, in terms of forex trading, there are more than 90 currency pairs available.

They answer to requests H24 with LiveChat and are available also with e-mail with your Account manager. I recently signed up with Fushion Markets and so far everything has been great. They have one of the lowest spreads in the market and commissions are low too. Customer support is always available and they do their best to assist. I’ve been with lots of brokers in the past but I found fushion to be the best so far with no issues. Please note that by investing in and/or trading financial instruments, commodities and any other assets, you are taking a high degree of risk and you can lose all your deposited money.

A VPS allows traders to run their trading platforms and algorithms on a remote server, which can help to improve the speed and reliability of transactions. Fusion Markets also offers copy trading solutions for passive investors, allowing them to follow and automatically replicate the trades of more experienced traders. While these tools may not be as extensive as those offered by some other brokers, they can still be helpful for specific traders and can help to enhance the trading experience. In addition to offering a range of account types, Fusion Markets offers its clients a wide range of trading instruments. These include more than 90 currency pairs, numerous commodities, equity indices, and shares CFDs. This gives traders a wide range of options to choose from and allows them to diversify their portfolios and take advantage of opportunities in different markets.

We look forward to your updated review after you’ve placed a couple of trades. Feel free to reach out to any of our helpful staff and let us know how we can be a 5-star broker in your eyes. At BrokerChooser, we consider clarity and transparency as core values. BrokerChooser is free to use for everyone, but earns a commission from some of its partners with no additional cost to you .

Open real account or open demo account with Fusion Markets

Fusion Markets offers clients trading ideas that are based on advanced indicators such as indicator movements or chart patterns. You can see target prices as well as determining if you should go short or long. Basic order types are available, but more complex ones, such as ‘one-cancels-the-other,’ are not. There are several order types to choose from, such as market, limit, and stop.

Is Fusion Markets a trusted broker?

Fusion Markets operates through two legal entities, both of which are also regulated by ASIC and the VFSC. The broker provides negative balance protection for its clients under ASIC, although there is no investor protection. That said, Fusion Markets should be a safe broker to trade with.

Overall, Fusion Markets is a reliable and trustworthy broker that offers a range of options to suit the needs of different traders. With an extensive hub of news available from within its client portal, Fusion Markets’ market research is excellent compared to other similar brokers. It also offers a great range of useful trading tools and provides access to two popular copy trading platforms.

Session times vary based on the market hours of their products, but these are all clearly listed on the companys website under their Trading Conditions section. Fusion Markets claims that it will not offer binary options to its clients due to their high risk. The Introducing Broker option is geared towards companies that wish to get recurring commissions from Fusion Markets for clients they refer. To take part, you must first get the approval of the broker.

Which FX broker is best?

- CMC Markets – Excellent overall, best platform technology.

- TD Ameritrade – Best desktop platform, U.S. only.

- FOREX.com – Excellent all-round offering.

- City Index – Excellent all-round offering.

- XTB – Great research and education.

- eToro – Best for copy and crypto trading.

I like the web platform as it can run on any device and is always up to date. Traders can access a complimentary VPS sponsored by Fusion if they trade more than 20 lots of FX or Metals in a 30-day period. Proof of Address – Proof of residence/address document must be issued in the name of Fusion Markets’ account holder within the last six months. It must contain a trader’s full name, current residential address, issue date, and issuing authority. Fusion Markets does not have its own trading app, but MT4 and MT5 are all available as mobile apps.

Regarding trading software, there is a huge variety as the broker offers the standard MT4 and MT5 trading platforms alongside with WebTrader, DupliTrade, and MyFXBook Auto trading software. However, the platform also has an excellent customer support team that can be reached 24/7. First up, Fusion Markets offers the MetaTrader 4 platform for desktop users. Anyone familiar with forex or CFD trading will know that MT4 is arguably the market leader. It offers a huge number of professional-level tools as well as myriad charting options.

Changing the leverage is a very useful feature if you want to lower the risk of your trade.Be careful with forex and CFD trading, as preset leverage levels are very high. We tested the depositing process and found that a bank transfer may take several business days while payment with a credit/debit card is instant. You can only deposit money from accounts that are in your name. We also compared Fusion Markets’s fees with those of two similar brokers we selected, IC Markets and Pepperstone. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of Fusion Markets alternatives.

On the mobile trading interface, you get to select from a variety of languages. But on Android devices, changing the language is not that easy, as you must change your phone’s default language first. It would be more secure to use two-step authentication, so it’s not really in their favor. The search functions are average, and the assets are organised into categories. Fusion Markets doesn’t have its own trading platform; instead, it uses MetaTrader 4, which is a third-party platform.

I chosen Fusion Markets for the low commissions and the very good conditions of Leverage, of Margin Call and Stop Out. They offer a big number of way for deposits and withdrawals; including Paypal. They respond to request H24 with LiveChat and are available also with e-mail with your Account manager. I chosen Fusion Markets for the low commissions and the very good conditions of Leverage, Margin Call and Stop Out. They offer many ways for deposits and withdrawals; including Paypal.

Very good broker – I think it’s underrated here on myfxbook. Before you sign up for a copy trading account, make sure that you’ve analyzed the broker’s reputation and the trader’s performance history. While some brokers may be sincere, others will just recommend anyone, regardless of whether or not they have any track record. A good broker will look for a trader with a steady history of profits. Avoid ‘one-time big-money traders’ because they aren’t worth copying. We ranked Fusion Markets’s fee levels as low, average or high based on how they compare to those of all reviewed brokers.

The firm is Australian based so having two local licenses is definitely a good thing. Some of our reviewed brokers & content involves margin products like CFDs. When considering withdrawals, the broker is very accommodating with bank transfers, credit cards, and e-wallets as choices.

Recommended Posts

Двойная вершина и двойное дно Графические паттерны TradingView

October 19, 2022

Nano information, price for today and XRB market cap

September 30, 2022

Nano information, price for today and XRB market cap

September 30, 2022