How to Use Real Estate to Put off Tax Bills

by baraknew

Content

Our firm specializes in this service area and has a proud track record of helping short term rental property investors minimize their tax burden and build wealth. You can also take advantage of a property depreciation deduction each year.

Do landlords pay taxes on rent?

Landlords must report to the IRS all rental income for properties they own. Landlords can then take certain deductions against the rent they receive. For example, they can deduct depreciation, repairs, and other costs of being a landlord. The landlord must then pay taxes on the net rent income they report on Schedule E. If you have more than three rental properties, you’ll need several Schedule E forms.

Preparing taxes may sometimes feel like you’re giving away your profit. Utilizing as many deductible expenses for rental property management as possible ensures that your profits are maximized. Still, investors need to utilize all possible tax breaks for rental property. Deductions offset the money spent on maintaining, repairing, and managing rental properties. Without accounting for these standard expenses, taxes on rental income would be impossible to balance into your business’s bottom line. Passive losses are defined as losses arising from an investment where you are not a material participant. Losses from long-term rental properties are usually considered passive losses.

Offset Gains With Losses

Since that money is considered earned income, you’re on the hook for the payroll tax. But, if you’re a rental property owner instead, you would get to keep that cash in the bank.

Commercial https://personal-accounting.org/ owners should pay careful attention to this practice, known as advance rent, as leases tend to last for multiple years. Back in November, the House passed the $1.7 trillion “Build Back Better Act,” a scaled-down version of the original Plan proposed by Biden. Several tax provisions, including increasing the top capital gains tax rate to 25%, were eliminated from the Act. The Senate is expected to vote on the Act early this year, and any modifications made to the original legislation will require a return to the House for a final vote. Currently, the maximum tax paid for long-term capital gains is 20% for people earning over $501,600 . If the proposal had become law, the top capital gain tax would have been increased to 39.6% for households with over $1 million in reported income.

Calculating Tax On Rental Income Example

Attorney How to minimise the tax paid in your rental profits, property management fees, accountant fees, and advisor fees may be deducted under operating expenses. The longer you hold a rental property the more potential profit you stand to make. Unfortunately, when the time comes to sell, you could be facing a pretty significant tax bill that will take a big bite out of your profits. As a landlord, you will only pay council tax for your properties when they are vacant.

- Unlike repairs, capital expenses are changes to the property that are larger and beyond the scope of standard maintenance.

- Rental income is included in this deduction if it rises to the level of a trade or business.

- The IRS provides certain tax benefits that expat property owners can use to reduce their US tax bill.

- For this reason, some investors choose to convert rental properties into their primary residences.

- Quarterly returns are due on September 20, December 20, and March 20 each year.

- If the owner manages the property then the owner is an active participant, while if someone else manages the property the owner is considered a non-active participant.

- The rationale for this exception is based on the supposition that the landlord is taking less risk over renting to a stranger.

Recommended Posts

Accounting and Consulting Services for Wineries, Vineyards

April 12, 2024

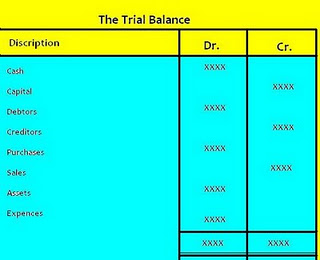

Adjusted Trial Balance What Is It, Example, Accounting, Purpose

February 12, 2024

A guide to startup costs for a business

October 13, 2023