Gross Compensation

by baraknew

Content

Also, flowers or fruit or similar items provided to employees under special circumstances . Employees provide reasonable substantiation that payments or reimbursements are for qualifying expenses. It doesn’t pay more than 5% of its payments during the year for shareholders or owners . If the cost of awards given to an employee is more than your allowable deduction, include in the employee’s wages the larger of the following amounts. A former common-law employee you maintain coverage for in consideration of or based on an agreement relating to prior service as an employee.

Moving expenses may also be deducted to report to a new location after obtaining employment. The distance test requires the new workplace to be at least 35 miles farther from the old residence than the old workplace was. Capital gain equal to difference between sale price of stock and exercise price of option.

What Is an accountable plan?

This amount must be included in the employee’s wages or reimbursed by the employee. Generally, determine your gross profit percentage in the line of business based on all property you offer to customers and your experience during the tax year immediately before the tax year in which the discount is available. To figure your gross profit percentage, subtract the total cost of the property from the total sales price of the property and divide the result by the total sales price of the property.

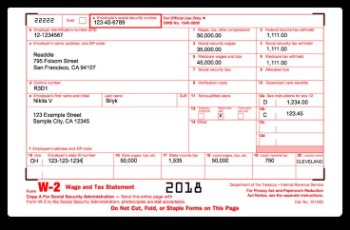

The Department of Revenue requires a copy of the military orders directing the taxpayer to federal active duty outside the commonwealth. Residents must file a Pennsylvania personal income tax return and include their W–2 form and copies of their military orders as evidence of active duty military pay earned outside Pennsylvania. Every employer that is required to withhold federal income tax from wages paid to an employee is also required to withhold Pennsylvania personal income tax from all taxable compensation paid to that employee.

Employee benefits can be taxable or nontaxable

If you invested in a retirement annuity that is not part of an employer-sponsored program or a commonly recognized retirement program, you have Pennsylvania-taxable income when you begin receiving annuity payments. You must report the difference between the amount you receive and your previously taxed investment as taxable gain on a PA-40 Schedule D, Sale, Exchange, or Disposition of Property. If you receive periodic payments, you use the cost-recovery method to report the taxable gain. This includes executor’s fees paid to nonresident executors and administrators for estates in Pennsylvania. It is presumed that these fees are received for services performed in Pennsylvania by the executor and/or his or her agent and the burden of proof falls upon the taxpayer to prove otherwise. Any apportionment must be reported on PA-40 Schedule NRH, Apportioning Income by Nonresident Individuals. Generally, coverage and amounts paid under policies of accident or health insurance issued by a commercial third party insurance company, including loss of income insurance or accident or health plans, are not taxable.

Tax Benefits for Education

Tax benefits can help with a variety of education-related expenses. These expenses include tuition for college, elementary, and secondary school.Find Out if You Qualify for Education BenefitsUse the Interactive Tax Assistant to see if you’re eligible for education credits or deductions. These include the:American Opportunity CreditLifetime Learning CreditStudent loan interest deductionLearn About Claiming Education BenefitsAn education credit helps you pay education expenses by reducing the amount you owe on your tax return. There are two types of education credits:The American Opportunity Tax Credit helps with expenses during the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student. If the credit lowers your tax to zero, you may get a refund.The Lifetime Learning Credit (LLC) can be used toward tuition payments and related expenses. To use the credit, you must attend a qualifying educational institution. Use the LLC for undergraduate… Ещё

Please complete a paper or electronic PDF Form W-4 to modify state tax withholding. Employees should also check their local state government’s website to confirm details about state withholding forms. You may change this setup at any time by submitting a new W-4 request. If an employer chooses instead to subsidize the benefit it is actually more valuable than an equivalent raise because of the tax advantages (for example, if a subsidy of $190 is offered, this equals roughly $317 in taxable income).

Amending Estimated Tax Payments

Our software allows you to securely upload your tax documents to our system so they’re available to your tax expert. You may be able to import them directly from your employer or your financial institutions, or you can snap photos of the documents and upload them to TurboTax. We use bank-level encryption technology to ensure your information is protected. We use information about your tax situation to match you with an expert who has experience with taxes like yours. During the process, they’ll also learn more about your unique situation so they can make sure your taxes are 100% correct before filing.

The value of the vacation is Discounts & Benefits Tax Withholding Work able Pennsylvania compensation to the employee. The description, “See PA Schedule C for List of Expenses” should be included on the Miscellaneous Expenses line in Part C of PA Schedule UE. Expenses paid directly or through a withholding arrangement with an employer. Stipends paid to medical interns and residents pursuant to an internship or residency program that conforms to the Essentials of an Approved Internship or the Essentials of an Approved Residency as established by the American Medical Association are taxable. Calculate a “total performances within the commonwealth ” versus “total performances” fraction. Multiply this fraction against the taxpayer’s total apportionable compensation. Active State duty pay received for services both within and outside the commonwealth.

Additionally, Pennsylvania does not tax the employee’s use of employer property. Stock options earned while working in Pennsylvania are subject to personal income tax even though exercised while a resident of another state. If a taxpayer works in multiple states and earns stock options in Pennsylvania and other states during his employment, the taxpayer is entitled to apportion the income earned based on the time taxpayer worked in Pennsylvania.

- Miscellaneous Taxes and FeesMontana has several taxes covering specific businesses, services, or locations.

- Any other income earned by the spouse for services performed in North Carolina is subject to North Carolina income tax.

- The amount of payments and reimbursements doesn’t exceed $5,850 ($11,800, for family coverage) for 2023.

- Also, employee discounts provided by another employer through a reciprocal agreement aren’t excluded.

- Employee Benefits Offer health, dental, vision and more to recruit & retain employees.

- Employee has no option to receive additional cash compensation in lieu of assistance.

Generally, https://intuit-payroll.org/ insurance isn’t group-term life insurance unless you provide it at some time during the calendar year to at least 10 full-time employees. For each employee, you must report in box 12 of Form W-2 using code “GG” the amount included in income in the calendar year from qualified equity grants under section 83.

Recommended Posts

Accounting and Consulting Services for Wineries, Vineyards

April 12, 2024

Adjusted Trial Balance What Is It, Example, Accounting, Purpose

February 12, 2024

A guide to startup costs for a business

October 13, 2023